Why Are Tariffs Bad?

Tariffs are designed to transfer of the tax burden from the rich to the rest of us

Regressive Taxes: Taxes where the more money you make, the less you pay in taxes as a % of your income. The poorest pay the most and the richest pay the least.

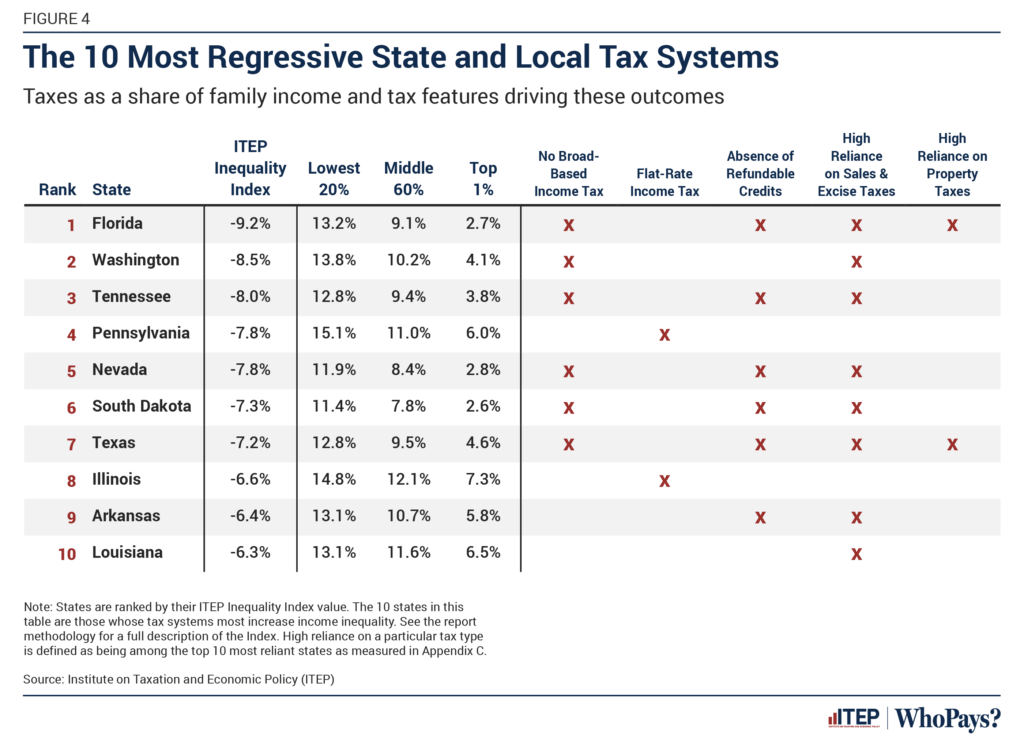

Florida is the most regressive state because of the reliance on sales / consumption taxes. The poorest pay over 13% of their income to pay for Florida and the rich pay under 3% because of this.

Tariffs are a regressive consumption tax, which squarely pushes the tax burden from the rich people to the rest of us.

Tariffs have nothing to do with protecting or benefiting our country.

The Project 2025 plan has goal of replacing all income and corporate taxes with consumption taxes like sales tax and tariffs.

Just like Florida, that pushes the tax burden down at the federal level.

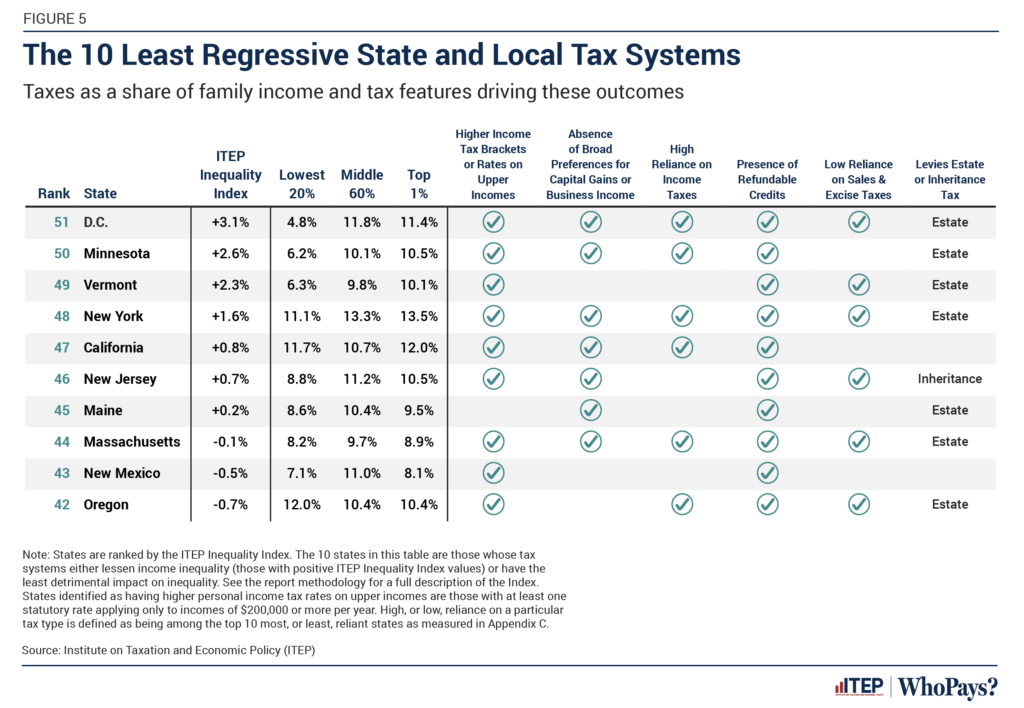

Notice the difference between states with most / least Regressive tax systems

This video uses information from ITEP to explain how tariffs will effect the poorest people the most and the richest people the list.

Institute on Taxation and Economic Policy (ITEP) is a non-profit, non-partisan tax policy organization.

This video (4 min) discusses:

Tariffs and the regressive tax system.

- The ITEP study – Who Pays is used to show the impact of regressive taxation on the effective tax rate as a % of your earnings.

- In short, the more a state relies on progressive taxes, the more of the cost burden is pushed to the lowest income earners.

- The video shows how implementing tariffs will result in shifting the tax burden to everyone from the upper-middle class to the poor, with the poorest of Americans being hit the hardest. And how this is a planned event, not just a result of something else.

Summary of the video

Tariffs push the tax burden from the rich to the working class and the poor, just like all regressive taxes.

In Florida, the bottom 20% pay 13% of their total income, just to run the state of Florida, not total taxes! The top 1% only pay 2.7% in the coffers.

Florida is not alone, every state that relies on regressive taxes are very similar. The least regressive states are the most equitable ones. In California, the middle class pay 1% less. In New York the bottom 20% pay 2% less. In Florida, the rich pay 10% less and in Texas they get a 8% discount to 4.6%. See the difference?

Those differences are directly related to having a consumable base tax system, which is what tariffs are.

The Project 2025 plan has goal of replacing all income and corporate taxes with consumption taxes like sales tax and tariffs.

They want to change the entire country to be just as inequitable as those states where the rich pay almost nothing the we all pay the rest. NUMBERS DO NOT LIE.

Tariffs have zero to do with protecting America or sending a message and 100% to do with pushing the tax burden onto the working people and the poor.

The super rich just took over policy and now we have a policy that shifts the tax burden away from them. That isn’t an accident, it was planned.

Other Regressive Taxes

- Gas taxes (excise). A person making 2M per year pays a tiny fraction of their income on gas, whereas a person driving to work everyday pays a huge % more

- If gas taxes are used to pay for the roads, the poorest people are paying largest % of their income to maintain those roads

- Sales tax is the regressive tax that has one of the largest impacts

- States that rely on sales tax are the most regressive and hence the tax burden is pushed to lowest income earners the most

- Social Security or anything that is capped. Anyone that makes under $176,000 pays it on every dime

Related Links:

Myth: Tariff is not a tax

ITEP – Who Pays

This study has a ton more details worth reading, just didn’t want to make a 20 minutes video